Global Markets

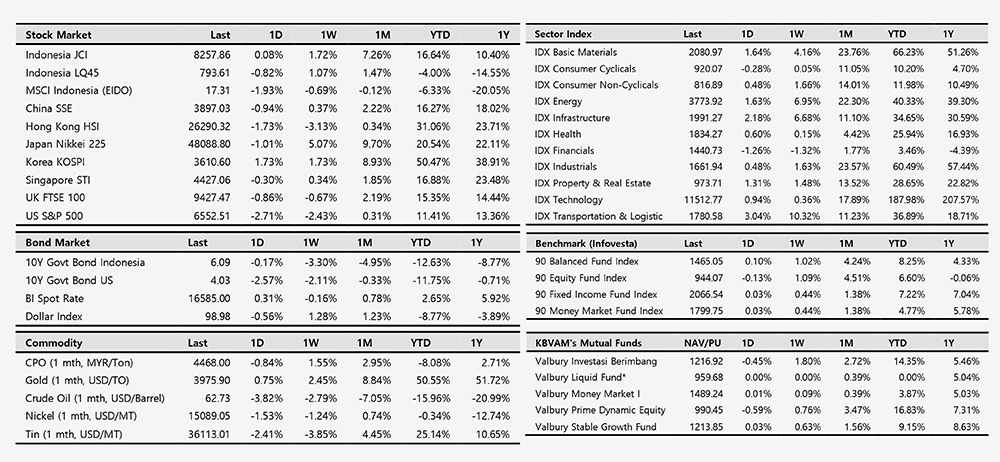

Geopolitical tensions between the U.S. and China escalated, following President Donald Trump’s threat to impose an additional 100% tariff on Chinese goods effective November 1, 2025. In response, China announced export restrictions on rare earth metals, intensifying fears of a renewed trade war. This pushed investors toward safe-haven assets, particularly U.S. Treasuries. Federal Reserve officials, including Christopher Waller and Mary Daly, signaled cautious support for further monetary easing while highlighting early signs of labor market softening.Indonesian Markets

Domestically, Indonesia’s local currency bond market strengthened as global risk sentiment improved and domestic liquidity remained abundant. Government bond yields declined across the curve, with the 10-year benchmark yield dropping 20–21 bps to around 6.09–6.12%, and the 5-year yield down 9 bps to 5.38%. The Jakarta Composite Index (JCI) rose 1.7% WoW to a record 8,258, led by conglomerate and commodity stocks. The Rupiah slightly weakened to IDR 16,570/USD, remaining broadly stable as Bank Indonesia was expected to provide liquidity support via open market operations.

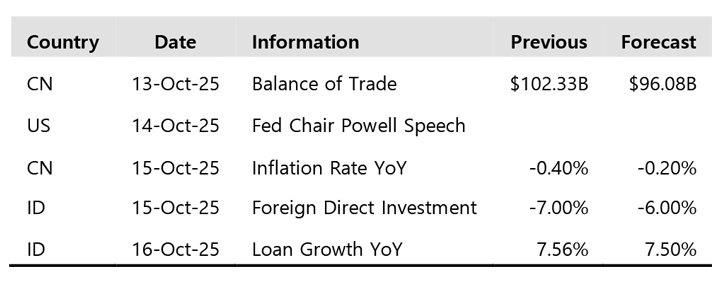

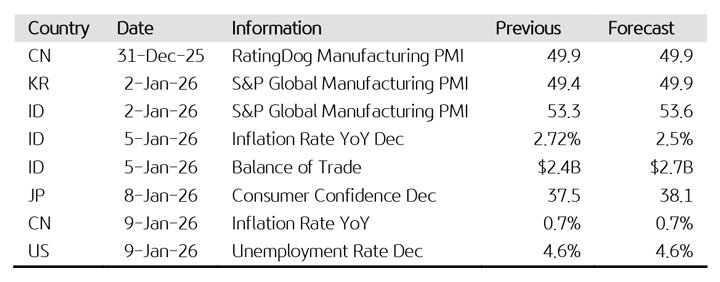

Weekly Highlight on Economic Indicators

Our Take:

The past week was dominated by renewed U.S.–China trade tensions, a prolonged U.S. government shutdown, and mounting expectations for Fed rate cuts, all of which drove a global bond rally. In Indonesia, stable domestic liquidity, robust auction demand, and controlled inflation helped sustain the bond market rally and maintain positive sentiment in equities, despite ongoing foreign outflows from the banking sector.The recommendation for investment to our investors (in order):

Fixed Income Fund > Equity Fund > Balanced Fund > Money Market Fund.

Author : KBVAM Investment Team

Source: Bloomberg, Infovesta, Trading Economics

DISCLAIMER :

INVESTMENT THROUGH MUTUAL FUNDS CONTAINS RISKS. PROSPECTIVE INVESTORS MUST READ AND UNDERSTAND THE PROSPECTUS BEFORE DECIDING TO INVEST THROUGH MUTUAL FUNDS. PAST PERFORMANCE DOES NOT REFLECT FUTURE PERFORMANCE.

This document was prepared based on information from reliable sources by PT KB Valbury Asset Management. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising, whether against or suffered by any person or party and in any way deemed to be a result of actions taken on the basis of all or part of this document.

Latest Weekly Insight

Weekly Insight

Correction Phase

26 January 2026Weekly Insight

Correction Phase

26 January 2026

Global MarketsGlobal markets are volatile with a cautious bias amid geopolitical risks. Pressure from US tariff issues eased as threats related to Greenland were lifted, supported by the US GDP for the third quarter of 2025 being revised upward from 4.3% to 4.4%, without inflationary pressure and improving global sentiment, encouraging limited risk-on sentiment. President Trump has added to political tensions by imposing new sanctions and hinting at potential military action against Iran. The Fed is expected to keep its benchmark interest rate at 3.5%-3.75%. Next week's focus will be on the FOMC, with market direction determined by Powell's tone on the timing of interest rate cuts in 2026 and the release of PPI and labor data that could trigger volatility.

Indonesian MarketsDomestic stock market recorded a decline, pressured by profit taking, a strengthening US dollar, and rising US Treasury yields, which triggered foreign outflows. In addition, the volatility of the rupiah and policy uncertainty following the revocation of PT Agincourt Resources' Martabe gold mining permit also affected market sentiment. Next week, the market is expected to consolidate, with investors awaiting the announcement of MSCI's free float calculation methodology (30/01) and monitoring domestic macro data and FY2025 banking-consumption financial reports, with external risks remaining dominant from the US Core PCE and the direction of Fed policy.

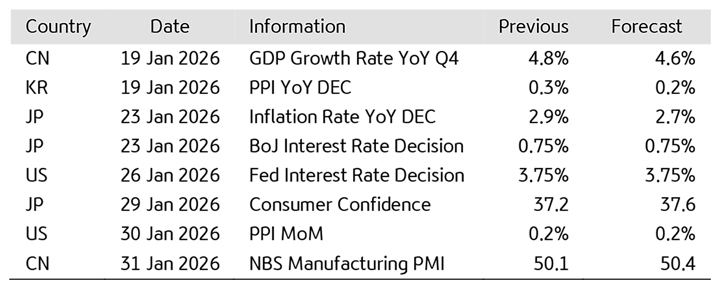

Weekly Highlight on Economic Indicators

Our Take:The JCI corrected 1.37% WoW to 8,951 from 9,075, with high volatility, despite briefly hitting an ATH of 9,134. Liquidity increased (ADV +9.32%; transaction value +3.59%), but market capitalization dropped 1.62% to IDR 16,244 trillion, reflecting dominant selling pressure. The decline was triggered by a net foreign sell of IDR 3.25 trillion, led by banking and mining; sectorally, the decline was led by Transportation & Logistics, Industrials, Energy, and Technology, signaling a correction phase with a cautious bias amid active investor distribution.

The recommendation for investment to our investors (in order):

Equity Fund > Fixed Income Fund > Balanced Fund > Money Market Fund.

Author : KBVAM Investment TeamSource: Bloomberg, Infovesta, Trading Economics

DISCLAIMER :INVESTMENT THROUGH MUTUAL FUNDS CONTAINS RISKS. PROSPECTIVE INVESTORS MUST READ AND UNDERSTAND THE PROSPECTUS BEFORE DECIDING TO INVEST THROUGH MUTUAL FUNDS. PAST PERFORMANCE DOES NOT REFLECT FUTURE PERFORMANCE.This document was prepared based on information from reliable sources by PT KB Valbury Asset Management. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising, whether against or suffered by any person or party and in any way deemed to be a result of actions taken on the basis of all or part of this document.

Weekly Insight

Confidence at Highs

19 January 2026Weekly Insight

Confidence at Highs

19 January 2026

Global MarketsThe US stock market closed the week weaker but consolidated, even though the DJIA and S&P 500 hit record highs, supported by big bank earnings and a solid labor market (unemployment at 4.4%). Volatility increased due to Fed issues, while the AI rally and strengthening gold/silver kept risk appetite in wait-and-see mode. Next week is expected to be volatile with a cautiously optimistic bias, focusing on US PCE inflation, Flash PMI, consumer spending, continued Q4 earnings, and China's Q4 GDP. Globally, attention is on the World Economic Forum, ECB minutes, IEA oil report, and BoJ decisions with the sustainability of the rally remaining heavily dependent on corporate earnings strength.

Indonesian MarketsLast week, the Indonesian market recorded a historic moment with the stock index breaking its highest record, driven by domestic optimism and a global commodity rally, despite increased volatility due to geopolitical sentiment. Next week, the market is expected to consolidate, with a focus on Bank Indonesia's RDG regarding interest rate direction and Danantara's debut at the WEF Davos to attract global investment. Meanwhile, bonds and the Rupiah are likely to remain defensive as the US dollar strengthens, making selective buying strategies still relevant given the high level of short-term volatility.

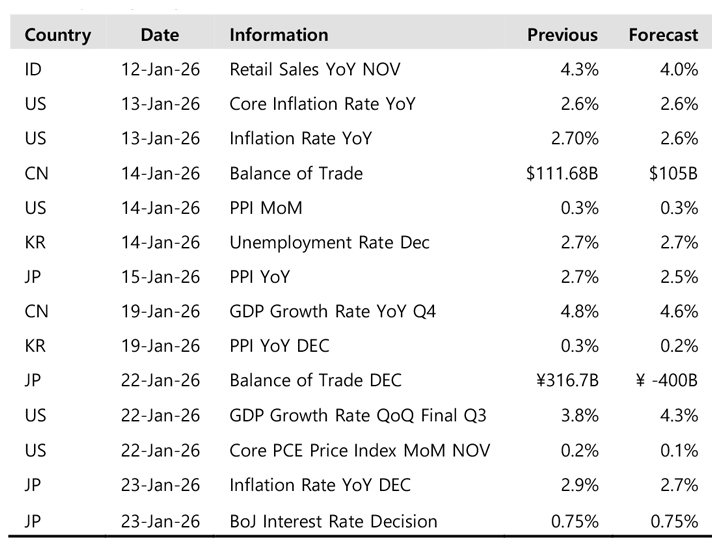

Weekly Highlight on Economic Indicators

Our Take:The JCI and IDX market capitalization hit an all-time high (9,075 (+1,55% WoW); IDR 16,512 trillion), supported by foreign net buying of more than IDR 3 trillion despite the weak rupiah, confirming confidence in domestic equities. The JCI is likely to consolidate with limited bullish bias after reaching an ATH, being selective with short-term profit-taking risks, while the direction is determined by the sustainability of foreign inflows, issuers' earnings expectations, as well as global volatility and rupiah movements.

Investment recommendations for our investors (in order of preference):

Equity Fund > Fixed Income Fund > Balanced Fund > Money Market Fund

Author : KBVAM Investment TeamSource: Bloomberg, Infovesta, Trading Economics

DISCLAIMER :INVESTMENT THROUGH MUTUAL FUNDS CONTAINS RISKS. PROSPECTIVE INVESTORS MUST READ AND UNDERSTAND THE PROSPECTUS BEFORE DECIDING TO INVEST THROUGH MUTUAL FUNDS. PAST PERFORMANCE DOES NOT REFLECT FUTURE PERFORMANCE.This document was prepared based on information from reliable sources by PT KB Valbury Asset Management. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising, whether against or suffered by any person or party and in any way deemed to be a result of actions taken on the basis of all or part of this document.

Weekly Insight

Bullish Breakout

12 January 2026Weekly Insight

Bullish Breakout

12 January 2026

Global MarketsThe US global market closed strongly, with major indices posting weekly gains, driven by a rotation into the raw materials and industrial sectors, as US labor data softened but still reflected a resilient economy, reinforcing the soft landing narrative. However, expectations for interest rate cuts remain limited as US Treasury yields remain high. This week's focus shifts to the release of U.S. inflation (CPI) and the start of the Q4 earnings season, with the main attention on 2026 earnings guidance to test the sustainability of the January Effect amid already elevated market valuations and profit taking risks.

Indonesian MarketsIndonesian market is moving constructively, supported by a rotation to value stocks and solid investor participation with neutral foreign inflows. The bond market is cautious with limited SBN yield increases following global trends, a stable rupiah, and inflation remaining within Bank Indonesia's target. This week, the market is likely to move sideways with volatility remaining contained, awaiting the Trade Balance (surplus), the start of FY2025 banking earnings, and US data shaping Federal Reserve expectations, although short term profit taking remains a risk.

Weekly Highlight on Economic Indicators

Our Take:The JCI increased +2.16% WoW to 8,936, hitting a consecutive ATH of 8,944.8 and briefly breaking through 9,000 intraday (peak 9,002.9), confirming the domestic risk-on momentum. The IDX market capitalization rose +1.79% WoW to IDR 16,301 trillion, supported by foreign net buying of IDR 2.56 trillion in a week and IDR 3.1 trillion YTD 2026. Liquidity surged significantly, reflected in the average daily transaction value of +44.68% WoW to IDR 31.45 trillion. Technically, the JCI trend remains bullish as long as the index stays above the bullish trendline, the opportunity for a continued rally remains open with correction risks still manageable.

Investment recommendations for our investors (in order of preference):

Equity Fund > Fixed Income Fund > Balanced Fund > Money Market Fund

Author : KBVAM Investment TeamSource: Bloomberg, Infovesta, Trading Economics

DISCLAIMER :INVESTMENT THROUGH MUTUAL FUNDS CONTAINS RISKS. PROSPECTIVE INVESTORS MUST READ AND UNDERSTAND THE PROSPECTUS BEFORE DECIDING TO INVEST THROUGH MUTUAL FUNDS. PAST PERFORMANCE DOES NOT REFLECT FUTURE PERFORMANCE.This document was prepared based on information from reliable sources by PT KB Valbury Asset Management. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising, whether against or suffered by any person or party and in any way deemed to be a result of actions taken on the basis of all or part of this document.

Weekly Insight

Market Breakthrough

05 January 2026Weekly Insight

Market Breakthrough

05 January 2026

Global MarketsOver the past week, the US stock market has been mixed with low volatility amid thin post-holiday volumes, with profit-taking on technology/AI stocks weighing on the Nasdaq, while the Dow Jones has been relatively more resilient, supported by cyclical stocks. Globally, markets are tending to wait and see, influenced by expectations of Fed policy, fluctuations in US Treasury yields, and consolidation after the strong rally in 2025. Entering this week, sentiment could potentially worsen amid geopolitical escalation following the US attack on Venezuela and the detention of the Venezuelan president, as well as statements of US control over the oil sector, which increase global geopolitical risk and drive rotation into safe haven assets (USD, gold). Looking ahead, the market is expected to be more active but remain range-bound, with a focus on early January US economic data (employment, PMI, inflation) and Fed communications. Defensive sectors and fundamentally strong stocks are likely to be favored, while highly valued stocks remain vulnerable to correction.

Indonesian MarketsLast week, Indonesia's financial markets closed positively despite limited liquidity due to the New Year holidays, with gains at the start of the year reflecting risk-on sentiment after the holidays. Support came from December 2025's manufacturing PMI, which remained at an expansionary level of 51.2, despite slowing from 53.3 in November, indicating continued growth but at a more moderate pace. Looking ahead, market attention will focus on the release of December 2025 inflation and trade balance data as determinants of policy expectations and external stability. Globally, the Fed minutes revealed differing views on the timing of interest rate cuts in 2026, but the easing bias remains supportive of risk asset sentiment.

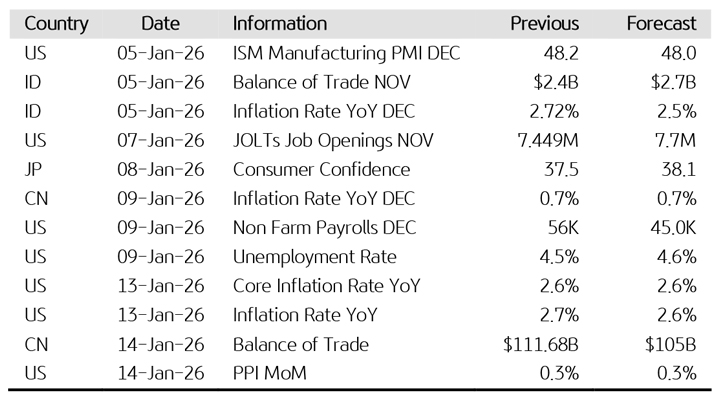

Weekly Highlight on Economic Indicators

Our Take:The stock market index (JCI) increased by +2.4% WoW to 8,748 in the past week. The year 2025 ended strongly overall with the JCI rising around 22% YoY, the best annual performance since 2014, driven by conglomerate stocks, dovish central bank policies, and investor inflows. The positive catalyst driving the JCI came from market optimism regarding Finance Minister Purbaya's confidence that the Composite Stock Price Index (JCI) in 2026 has the potential to break through the 10,000 level or higher. This optimism is also reflected in the strengthening of the JCI in 2025, as well as market participants' confidence in future economic improvement.

Investment recommendations for our investors (in order of preference):

Equity Fund > Fixed Income Fund > Balanced Fund > Money Market Fund

Author : KBVAM Investment TeamSource: Bloomberg, Infovesta, Trading Economics

DISCLAIMER :INVESTMENT THROUGH MUTUAL FUNDS CONTAINS RISKS. PROSPECTIVE INVESTORS MUST READ AND UNDERSTAND THE PROSPECTUS BEFORE DECIDING TO INVEST THROUGH MUTUAL FUNDS. PAST PERFORMANCE DOES NOT REFLECT FUTURE PERFORMANCE.This document was prepared based on information from reliable sources by PT KB Valbury Asset Management. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising, whether against or suffered by any person or party and in any way deemed to be a result of actions taken on the basis of all or part of this document.

Latest Daily Market Wrap

Daily Market Wrap

January 28, 2026

28 January 2026Daily Market Wrap

January 28, 2026

28 January 2026NEWS

- America : Wall Street was mixed (S&P +0.70%, Nasdaq +0.91%, Dow -0.83%) driven by the earnings season and accumulation of technology stocks. The 10-year US Treasury yield rose slightly to 4.24%, reflecting the market's anticipatory stance despite lingering concerns over inflation and the US fiscal deficit. The market is adopting a wait-and-see approach ahead of the FOMC meeting.

- Asia : Asian markets closed higher (Nikkei +0.85%, China SSE +0.18%, KOSPI +2.73%, Hang Seng +1.35%) were driven by bargain hunting of semiconductor stocks, a weakening yen that supported Japanese exporters, supported by China's more accommodative policy signals and expectations of continued stimulus, although investors remained wait and see ahead of the Fed's policy decision and the release of further economic data.

MARKET UPDATE

- The JCI rose +0.05% to 8,980, held back by concerns over central bank independence and foreign selling, as well as the issue of Danantara potentially taking over 28 companies following the revocation of licenses due to the Sumatra disaster, which triggered negative sentiment that weighed on the JCI, causing it to rise only slightly, while global markets waited ahead of the FOMC.

- Bond market: The 10-year SUN yield rose to 6.34%, as bond prices corrected due to investor caution regarding BI's monetary policy, foreign outflows, and unstable global sentiment. Inflationary pressures and the Fed's still-tight stance have made investors defensive, despite improving domestic liquidity.

Source : Bloomberg, Infovesta --- DISCLAIMER : INVESTMENT IN MUTUAL FUNDS INVOLVES RISKS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. BEFORE INVESTING, PLEASE CAREFULLY READ AND UNDERSTAND THE PROSPECTUS. This document was prepared by PT KB Valbury Asset Management based on information from reliable sources. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising from actions taken based on this document, whether suffered by any person or party.

Daily Market Wrap

January 27, 2026

27 January 2026Daily Market Wrap

January 27, 2026

27 January 2026NEWS

- America : Wall Street closed mixed (S&P +0.50%, Nasdaq +0.43%, Dow +0.64%) amid a rotation into the technology sector ahead of AI companies' earnings releases. Held back by President Trump's threat of 100% tariffs on Canada and escalation in the Middle East. The 10Y UST yield fell to 4.21%, reflecting expectations of an economic slowdown due to aggressive tariff policies and focus on awaiting the Fed's decision.

- Asia : Asian markets closed mixed with a downward trend (Nikkei -1.79%, China SSE -0.09%, KOSPI -0.81%, Hang Seng +0.06%), due to geopolitical escalation in the Middle East and President Trump's threat of global tariffs. In addition to selling pressure on exporter stocks due to the strengthening yen, the wait-and-see attitude towards the Fed and PBOC policies shows that investor risk appetite remains fragile and highly sensitive to global dynamics.

MARKET UPDATE

- The JCI rose 0.27% to 8,975, supported by a surge in commodity stocks amid energy price fluctuations and positive IMF sentiment towards the Indonesian economy. Despite strengthening, the market was overshadowed by high volatility and net foreign selling of banking stocks due to global geopolitical concerns and uncertainty over Fed policy.

- Bond market: The 10-year SUN yield fell to 6.35%, driven by the strengthening of the Rupiah (Rp16,779) and the flattening of the 10-year UST yield. Although selling pressure eased, low transaction volumes indicate investor caution regarding the fiscal risk of the 2026 state budget deficit and changes in the government's debt tenor strategy.

Source : Bloomberg, Infovesta --- DISCLAIMER : INVESTMENT IN MUTUAL FUNDS INVOLVES RISKS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. BEFORE INVESTING, PLEASE CAREFULLY READ AND UNDERSTAND THE PROSPECTUS. This document was prepared by PT KB Valbury Asset Management based on information from reliable sources. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising from actions taken based on this document, whether suffered by any person or party.

Daily Market Wrap

January 21, 2026

21 January 2026Daily Market Wrap

January 21, 2026

21 January 2026NEWS

- America : Wall Street weakened sharply with the S&P 500 down 2.06%, the Dow Jones down 1.76%, and the Nasdaq down 2.39%, the deepest decline since October 2025 amid a surge in volatility and risk aversion. The pressure was triggered by Donald Trump's tariff threats against European countries, which increased the risk of a trade war, prompting a shift to defensive assets. The 10-year US Treasury yield rose to 4.29%, reflecting the repricing of long-term risk amid geopolitical uncertainty.

- Asia : Asian markets weakened with the Nikkei 225 down 1.11%, KOSPI down 0.39%, and China's SSE down 0.01%, while the Hang Seng was up 0.29%, reflecting global risk-off sentiment following new US tariff threats that sparked concerns over regional export stability. Pressure was exacerbated by political uncertainty in Japan and the PBoC's decision to hold the LPR, confirming selective stimulus amid weak domestic demand in China.

MARKET UPDATE

- The JCI strengthened to 9,134 (+0.01%), remaining in a consolidation phase. Investors are taking a wait-and-see approach ahead of the BI RDG, with the BI Rate expected to remain at 4.75% to maintain the stability of the Rupiah at Rp16,900 USD. The weakening of the Rupiah has encouraged selectivity towards exporter/commodity stocks, while import-cost stocks are under pressure. The rally remains solid, but volatility has increased in line with profit-taking after a long rally.

- Bond market: The 10Y SUN yield rose to 6.31%, reflecting moderate selling pressure due to an increase in risk premiums amid the weakening of the Rupiah, as well as perceptions of the direction and independence of BI's monetary policy, which increased the demand for long-term risk compensation. Repricing was also triggered by the risk of foreign outflows and global uncertainty, although the market is watching for opportunities for the Fed Funds Rate to moderate towards the end of Q1-2026.

Source : Bloomberg, Infovesta --- DISCLAIMER : INVESTMENT IN MUTUAL FUNDS INVOLVES RISKS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. BEFORE INVESTING, PLEASE CAREFULLY READ AND UNDERSTAND THE PROSPECTUS. This document was prepared by PT KB Valbury Asset Management based on information from reliable sources. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising from actions taken based on this document, whether suffered by any person or party.

Daily Market Wrap

January 20, 2026

20 January 2026Daily Market Wrap

January 20, 2026

20 January 2026NEWS

- America : US stock markets closed in observance of Martin Luther King Jr. Day. However, risk-off sentiment was reflected in the weakening of futures indices throughout the holiday, reflecting investor caution regarding geopolitical risks and global trade policy uncertainty.

- Europe: European markets closed lower with the European STOXX 600 Index falling 1.2%, the sharpest daily decline in the last two months, triggered by political tensions over President Trump's threat of tariffs against eight NATO member countries if they oppose Trump's plan to take control of Greenland, as well as economic data from China.

-

Asia : Asian stock markets closed mixed this afternoon with a risk-off sentiment amid geopolitical escalation and US tariff threats. Pressure was seen in the Nikkei 225, which fell 0.65%, and the Hang Seng, which weakened 1.05%. On the other hand, the Kospi rose 1.32%, driven by positive sentiment toward domestic technology stocks, while China's SSE rose 0.29%, showing the resilience of the Chinese stock market despite slowing growth momentum.

- The JCI hit an ATH of 9,133 (+0.64%), driven by foreign funds, especially into big cap banking and consumer cyclicals, with strong liquidity (transaction value of IDR 35.7 trillion) ahead of the release of FY2025 performance of major banks. Domestic sentiment remains positive amid expectations that Bank Indonesia will hold interest rates steady, although external risks limit room for further increases and open up opportunities for short-term profit-taking.

- Bond market: The 10Y SUN yield rose to 6.28%, reflecting light selling pressure triggered by rising global yields as the 10Y UST remained high. Rupiah volatility and foreign investor outflows in medium to long tenors also weighed on the bond market. The widening SUN-UST spread indicates an increase in risk premium, reinforced by rebalancing into equities amid the JCI's record momentum.

Source : Bloomberg, Infovesta --- DISCLAIMER : INVESTMENT IN MUTUAL FUNDS INVOLVES RISKS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. BEFORE INVESTING, PLEASE CAREFULLY READ AND UNDERSTAND THE PROSPECTUS. This document was prepared by PT KB Valbury Asset Management based on information from reliable sources. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising from actions taken based on this document, whether suffered by any person or party.

Latest Publication

Publication

Promotion

23 December 2025Publication

Promotion

23 December 2025Promotion Terms & Conditions :

- Minimum purchase of KB Valbury Asset Management Mutual Fund equivalent to IDR 1,000,000 will get a Bonus of IDR 100,000 if the participants meet all the terms and conditions of the program.

- Valid for Valbury Prime Dynamic Equity Mutual Fund products.

- Purchases of Mutual Funds for this promotion program can only be made on January 5-9, 2026 and must be through BRAVO.

- Participants who do not make redemption transactions during the program period (5-30 January 2026) will get a maximum participation unit bonus of Rp. 100,000 (One Hundred Thousand Rupiah).

- Participants who make redemption transactions during the program period (5-30 January 2026) are considered to have failed and are not entitled to bonuses.

- The promotion is valid for the first 100 customers (new customers with no investment history)

- The promotion is not valid for KB Valbury Asset Management’s employees.

- The bonus is in the form of Valbury Prime Dynamic Equity mutual fund participation units.

- The bonus will be given, no later than 7 working days after the end of the promotion program.

- Taxes on the bonus received by the customer are borne by the Prize Recipient in accordance with applicable tax provisions.

- This promotion cannot be combined with other promotions.

General Conditions :

- Prizes are non-transferable.

- The decision of PT KB Valbury Asset Management in determining the winner is absolute and cannot be contested.

- KBVAM reserves the right to disqualify and cancel any bonus if there are indications of abuse of any form by participants and/or violations of terms and conditions.

- KBVAM may change or terminate the promo and it’s terms and conditions at any time without prior notice.

- This policy is effective from 5 January 2026 and if there are any changes it will be further confirmed.

- Provisions that have not been listed in this circular letter (if any) will be regulated later.

Publication

PLAN OF AMENDMENT KIK & PROSPECTUS OF MUTUAL FUND KBVAM

01 December 2025Publication

PLAN OF AMENDMENT KIK & PROSPECTUS OF MUTUAL FUND KBVAM

01 December 2025ANNOUNCEMENT OF PLANNING TO CHANGE COLLECTIVE INVESTMENT CONTRACTS ("KIK") AND PROSPECTUS OF MUTUAL FUNDS MANAGED BY PT KB VALBURY ASSET MANAGEMENT

PT KB Valbury Asset Management, as Investment Manager of:

- VALBURY STABLE GROWTH FUND;

- VALBURY INVESTASI BERIMBANG FUND;

- VALBURY LIQUID FUND;

- VALBURY MONEY MARKET I FUND; and

- VALBURY PRIME DYNAMIC EQUITY FUND.

intends to announce planned changes to the Investment Cooperative Investment Fund (KIK) and Prospectus of KB VALBURY MUTUAL FUNDS, with the following details :

I. Planned changes to the Investment Cooperative Investment Fund (KIK) and Prospectus of KB VALBURY MUTUAL FUNDS

- Change of the Investment Manager's name from "PT Valbury Capital Management" to "PT KB Valbury Asset Management";

- Change of the name of KB VALBURY MUTUAL FUNDS in connection with the change of the Investment Manager's name as referred to in point 1) above;

- Additional information on the Auto-debit mechanism for periodic payments for Participation Unit purchases of KB VALBURY MUTUAL FUNDS by KB VALBURY MUTUAL FUNDS Unit Holders.

- Additional payment methods for purchasing Participation Units in VALBURY MUTUAL FUNDS by Unit Holders can be made through a Virtual Account;

- Additional information that payment for purchasing Participation Units in VALBURY MUTUAL FUNDS into VALBURY MUTUAL FUNDS accounts can be made by transfer via electronic means, including payment gateways and QRIS (Quick Response Code Indonesian Standard), as long as it complies with applicable laws and regulations;

- Updated correspondence addresses for the Investment Manager for all VALBURY MUTUAL FUNDS, except for the VALBURY LIQUID FUND.

- Changes to the Composition of the Board of Directors and Investment Management Team of the Investment Manager; and

- Adjustments to the provisions in the KIK and Prospectus to the Laws and Regulations of the Financial Services Authority ("POJK"), including the following:

- Law Number 4 of 2023, dated January 12, 2023, concerning the Development and Strengthening of the Financial Sector;

- OJK Regulation Number 17/POJK.04/2022, dated September 1, 2022, concerning the Guidelines for Investment Manager Conduct;

- OJK Regulation Number 4 of 2023, dated March 30, 2023, concerning the Second Amendment to OJK Regulation 23/POJK.04/2016 concerning Mutual Funds in the Form of Collective Investment Contracts;

- OJK Regulation Number 8 of 2023, dated June 14, 2023, concerning the Implementation of Anti-Money Laundering, Counter-Terrorism Financing, and Counter-Proliferation of Weapons of Mass Destruction Programs in the Financial Services Sector;

- OJK Regulation Number 22 of 2023, dated December 22, 2023, concerning OJK Regulation Concerning Consumer and Community Protection in the Financial Services Sector;

- OJK Regulation Number 22/POJK.04/2017 dated June 21, 2017, concerning Securities Transaction Reporting; and

- OJK Regulation Number 33 of 2024 dated December 19, 2024, concerning the Development and Strengthening of Investment Management in the Capital Market;

- OJK Regulation Number 56/POJK.04/2020 dated December 3, 2020, concerning Mutual Fund Reporting and Accounting Guidelines (specifically for VALBURY INVESTMENT BALANCED MUTUAL FUNDS and VALBURY MONEY MARKET I MUTUAL FUNDS);

- OJK Regulation Number 31/POJK.07/2020 dated April 22, 2020, concerning the Provision of Consumer and Public Services in the Financial Services Sector by the Financial Services Authority (specifically for VALBURY INVESTMENT BALANCED MUTUAL FUNDS and VALBURY MONEY MARKET I MUTUAL FUNDS);

- OJK Regulation Number 18/POJK.07/2018 dated September 10, 2018 concerning Consumer Complaints Services in the Financial Services Sector (specifically for VALBURY INVESTMENT BALANCED MUTUAL FUNDS and VALBURY MONEY MARKET I MUTUAL FUNDS); and

- OJK Regulation Number 61/POJK.07/2020 dated December 14, 2020 concerning Alternative Dispute Resolution Institutions in the Financial Services Sector (specifically for VALBURY INVESTMENT BALANCED MUTUAL FUNDS and VALBURY MONEY MARKET I MUTUAL FUNDS).

Publication

Resolving Investment Disputes in the Right Way: Getting to Know LAPS SJK

04 November 2025Publication

Resolving Investment Disputes in the Right Way: Getting to Know LAPS SJK

04 November 2025As part of our commitment to transparency and investor protection, we support dispute resolution mechanisms through the Financial Services Sector Alternative Dispute Resolution Institution (LAPS SJK).

LAPS SJK is an independent institution licensed and supervised by the Financial Services Authority (OJK), which functions to assist in the fair, swift, and out-of-court resolution of disputes between consumers and financial service providers—including investment management companies.

The existence of LAPS SJK is regulated in OJK Regulation (POJK) Number 61/POJK.07/2020 concerning the Alternative Dispute Resolution Institution for the Financial Services Sector, which forms the legal basis for the implementation of non-litigation dispute resolution processes in the financial services industry.

Services Provided

- Mediation: dispute resolution by facilitating dialogue between disputing parties to reach a mutually beneficial agreement through a negotiation process between the disputing parties.

- Arbitration: resolution of civil disputes through an arbitrator's decision outside of the general court system based on an Arbitration Agreement made in writing by the disputing parties.

- Binding Opinions: Provision of professional views on differences in interpretation in the implementation of agreements, for example regarding: interpretation of unclear provisions; additions or changes to provisions related to the emergence of new circumstances; or regarding certain legal relationships of an agreement.

Through LAPS SJK, customers have an easily accessible and reliable dispute resolution channel, while companies can maintain their integrity, professionalism, and investor confidence.

For more information, visit the official website www.lapssjk.id.

Source : http://www.lapssjk.id

Publication

Cuan Challenge

09 July 2025Publication

Cuan Challenge

09 July 2025Program Terms & Conditions:

- Promotion applies to new, existing and KB group employees

- Customers who wish to participate in the CUAN CHALLENGE program are required to register in advance through the link available: bit.ly/joincuanchallenge

- For those who are interested in participating in the CUAN CHALLENGE program but are not yet KB Valbury Asset Management customers, they can open a mutual fund account online through BRAVO (https://bravo.valbury.co.id) or manually fill out a mutual fund account opening form before registering as a CUAN CHALLENGE program participant.

- Participants who have registered must make a subscription every month consecutively for 12 months, starting from the month when registering a minimum of Rp, 500,000, - (five hundred thousand rupiah).

- Products that are included in the CUAN CHALLENGE program are Mutual Fund Products: Valbury Money Market I

- Participants who do not make a subscription in 1 month or more during the regular investment period, will be disqualified.

- Participants who do not make redemptions and successfully complete the Cuan Challenge program for 12 months will get a participation unit bonus of Rp. 150,000 (one hundred and fifty thousand rupiah).

- The bonus will be given after each participant's periodic investment program ends in the form of mutual fund participation units (maximum 14 working days).

- Taxes on bonuses received by customers are borne by KB Valbury Asset Management in accordance with applicable tax regulations.

- Participants who have completed the Cuan Challenge program and have not made redemptions in the following 3 months will get an additional bonus of Rp.50,000 (fifty thousand rupiah).

- Prizes are non-transferable

- The decision of PT KB Valbury Asset Management (KBVAM) in determining the winner is absolute and cannot be contested.

- KBVAM has the right to disqualify and cancel the bonus if there are indications of misuse by participants and / or violations of the terms and conditions.

- KBVAM may change or terminate the promo and terms and conditions at any time without prior notice.

- This policy is effective as of August 01, 2025 and if there are any changes will be informed further.

- Provisions that have not been listed in this circular will be regulated later.