Global Markets

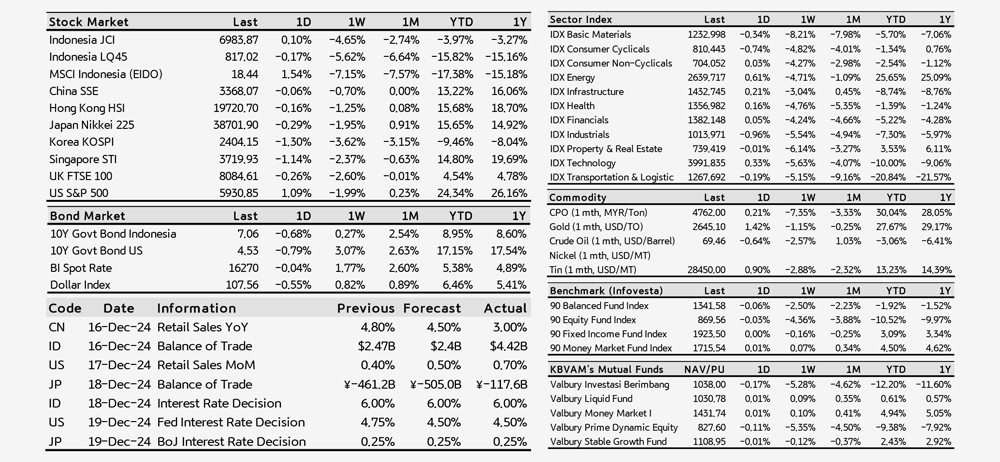

Major U.S. stock indexes experienced their steepest decline since mid-November following the Federal Reserve's indication of a more cautious stance on interest rate cuts in the coming year. This announcement unsettled markets, with the S&P 500 dropping 1.99% over the week. The Treasury market also saw a sell-off for the second straight week, pushing the 10-year government bond yield up to 4.53%.The Federal Reserve's move sent shockwaves through markets worldwide, impacting Asia significantly. Major indexes across the region registered weekly losses, including a 0.70% drop for China's SSE Composite, a 1.25% decline for Hong Kong's Hang Seng Index, a 1.95% fall for Japan's Nikkei 225, a 3.62% plunge for South Korea's KOSPI, and a 2.37% decrease for Singapore's Straits Times Index.

Indonesian Markets

Bank Indonesia maintained its interest rate at 6%, prioritizing stabilization of the Rupiah against the U.S. dollar. However, this measure was insufficient to counter the strengthening dollar following the Federal Reserve's announcement. The Rupiah weakened to 16,270 against the U.S. dollar. The Jakarta Composite Index (JCI) subsequently fell sharply by 4.65%, led by a 5.62% decline in the LQ45 index. Yields on 10-year government bonds remained steady at just above 7%.

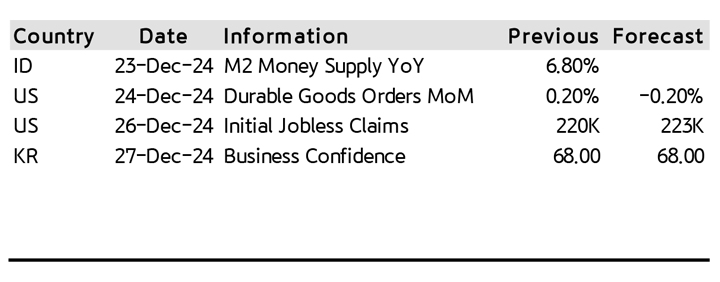

Weekly Highlight on Economic Indicators

Our Take:

Our equity fund, balanced fund, and fixed income fund recorded losses in this market situation. Valbury Prime Dynamic Equity decreased by 5.28% (BM: -4.36%), Valbury Investasi Berimbang decreased by 5.35% (BM: -2.50%), Valbury Stable Growth Fund decreased by 0.12% (BM: -0.16%). Meanwhile, Valbury Money Market I rose by 0.10% (BM: 0.07%).We anticipate a more stable market this week due to reduced trading activity during the year-end period and few major economic data releases scheduled.

The recommendation for investment to our investors (in order) :

Fixed Income Fund > Balanced Fund > Equity Fund > Money Market Fund.

Author : KBVAM Investment Team

DISCLAIMER :

INVESTMENT THROUGH MUTUAL FUNDS CONTAINS RISKS. PROSPECTIVE INVESTORS MUST READ AND UNDERSTAND THE PROSPECTUS BEFORE DECIDING TO INVEST THROUGH MUTUAL FUNDS. PAST PERFORMANCE DOES NOT REFLECT FUTURE PERFORMANCE.

This document was prepared based on information from reliable sources by PT KB Valbury Asset Management. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising, whether against or suffered by any person or party and in any way deemed to be a result of actions taken on the basis of all or part of this document.

Latest Weekly Insight

Weekly Insight

Consistent With Expectations

25 February 2025Weekly Insight

Consistent With Expectations

25 February 2025

Global MarketsEuropean equity funds experienced their most substantial weekly inflows in three years, with approximately $4 billion in capital entering the region through February 19th. This figure, the highest since February 2022, also confirms a second consecutive week of net inflows into European equities.

BofA strategist Michael Hartnett reiterated his preference for global stocks over US equities, citing improved business activity and the relative attractiveness of markets like Germany, China, Japan, and South Korea. He also cautioned that US markets face the risk of an unexpected economic slowdown. Amid a flight to safety, traders fueled a prolonged rally in US Treasuries, resulting in the US 10-year note yield dropping to 4.43%.

Indonesian MarketsBank Indonesia maintained its benchmark interest rate at 5.75% to stabilize the rupiah amidst global uncertainty and reduced expectations of Federal Reserve rate cuts. While noting potential for rate reductions due to low domestic inflation, the central bank opted for stability. This week, the 10-year government bond yield slightly increased to 6.79%, while the rupiah remained stable around 16,300 per US dollar. The broader stock market (JCI) saw a 2.48% gain, though the LQ45 index rose by a more modest 0.56%.

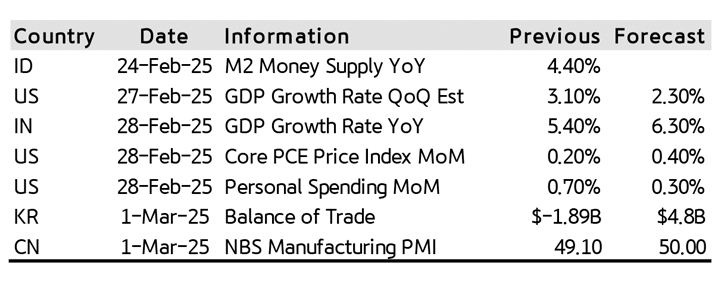

Weekly Highlight on Economic Indicators

Our Take:While stock and bond markets saw positive returns this week, our funds demonstrated outperformance relative to their peers. Valbury Prime Dynamic Equity rose by 1.42% (BM: 0.91%), Valbury Investasi Berimbang improved by 1.72% (BM: 0.52%), Valbury Stable Growth Fund gained 0.54% (BM: 0.22%) and Valbury Money Market I increased by 0.10% (BM: 0.10%).

Consistent with expectations, Bank Indonesia, maintained its interest rate, signaling caution amidst global uncertainty. This week's release of the Fed's preferred inflation gauge will provide investors with potential insights into the Fed's policy direction.

The recommendation for investment to our investors (in order) :

Fixed Income Fund > Money Market Fund > Balanced Fund > Equity Fund.

Author : KBVAM Investment Team

DISCLAIMER :INVESTMENT THROUGH MUTUAL FUNDS CONTAINS RISKS. PROSPECTIVE INVESTORS MUST READ AND UNDERSTAND THE PROSPECTUS BEFORE DECIDING TO INVEST THROUGH MUTUAL FUNDS. PAST PERFORMANCE DOES NOT REFLECT FUTURE PERFORMANCE.This document was prepared based on information from reliable sources by PT KB Valbury Asset Management. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising, whether against or suffered by any person or party and in any way deemed to be a result of actions taken on the basis of all or part of this document.

Weekly Insight

Rupiah Holds Steady

18 February 2025Weekly Insight

Rupiah Holds Steady

18 February 2025

Global MarketsJanuary's 0.9% drop in US retail sales—the steepest in nearly two years— signals a consumer spending pullback after late 2024's surge. This reignites Fed rate cut hopes despite strong inflation data. The bond market reacted positively to the news, closing the week with substantial gains. Meanwhile, the S&P 500 remained near its record highs, and the dollar weakened, reaching a new low for 2025.

DeepSeek's AI advancements are contributing to a shift in investment flows, with stock funds returning to China from India. This resurgence is reflected in a combined market capitalization increase of over $1.3 trillion for Chinese onshore and offshore equities in the past month, contrasting sharply with a more than $720 billion decline in India's market value. Specifically, the China SSE rose 1.30%, and the Hong Kong HSI saw a substantial 7.04% gain.

Indonesian MarketsIndonesia's capital market showed mixed results again last week. The Jakarta Composite Index (JCI) continued its decline, falling 1.54%, while the 10-year government bond yield dropped significantly to 6.74%.

Prabowo announced that Danantara will start operations this month. The sovereign wealth fund will invest in sustainable, high-impact projects across various sectors, with the goal of contributing to the country's 8% economic growth target. However, experts have raised concerns regarding the fund's strategy, governance, and its ability to achieve this ambitious objective.

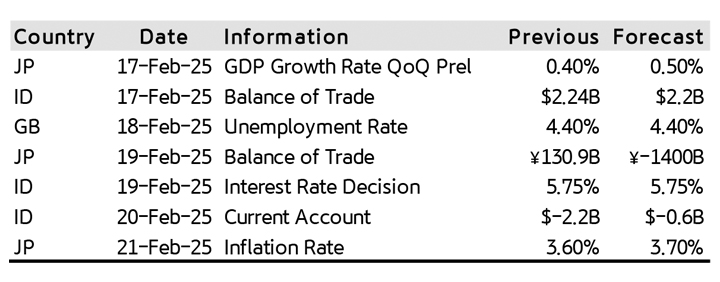

Weekly Highlight on Economic Indicators

Our Take:Our fixed income fund capitalized on the bond market rally with continued strong performance. Besides, despite the stock market downturn, our equity and balanced funds outperformed the market.

Valbury Prime Dynamic Equity declined by 0.32% (BM: -0.54%), Valbury Investasi Berimbang improved by 0.09% (BM: -0.06%), Valbury Stable Growth Fund gained 0.40 (BM: 0.33%) and Valbury Money Market I increased by 0.10% (BM: 0.09%). Softer recent U.S. economic data is providing support for a more stable rupiah and potentially giving Bank Indonesia (BI) room for future rate cuts. However, we expect BI to hold rates steady at this week's meeting.

The recommendation for investment to our investors (in order) :

Fixed Income Fund > Money Market Fund > Balanced Fund > Equity Fund.

Author : KBVAM Investment Team

DISCLAIMER :INVESTMENT THROUGH MUTUAL FUNDS CONTAINS RISKS. PROSPECTIVE INVESTORS MUST READ AND UNDERSTAND THE PROSPECTUS BEFORE DECIDING TO INVEST THROUGH MUTUAL FUNDS. PAST PERFORMANCE DOES NOT REFLECT FUTURE PERFORMANCE.This document was prepared based on information from reliable sources by PT KB Valbury Asset Management. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising, whether against or suffered by any person or party and in any way deemed to be a result of actions taken on the basis of all or part of this document.

Weekly Insight

Low Inflation

11 February 2025Weekly Insight

Low Inflation

11 February 2025

Global MarketsUS President, Donald Trump, announced plans to unveil reciprocal tariffs last week, escalating the ongoing trade war and further fueling inflation fears, wiping out the week’s gain in the US stock market. The S&P 500 fell 0.95% on Friday and closed the week down 0.24%. US economic data revealed weakening consumer sentiment amid inflation worries, while mixed jobs figures pointed to a moderating but still healthy labor market, with notable wage growth. This strengthens the Federal Reserve's position that it is in no hurry to lower borrowing costs.

Indonesian MarketsIndonesia's capital market diverged last week, with investors shifting from stocks to bonds. This shift was likely influenced by the recent inflation report, which showed a YoY rate of 0.76%, significantly below consensus forecasts.

The Jakarta Composite Index (JCI) plummeted 5.16%, led by a significant 14.52% drop in Bank Mandiri (BMRI) shares. This decline followed a JP Morgan report that underweight the bank. During the week, foreign investors withdrew US$231.1 million from the stock market (as of Feb 7th), while bond inflows reached US$371.7 million (as of Feb 6th).

Notably, global funds purchased a net US$581.3 million in Indonesian

bonds on Feb 6th, the largest single-day purchase since Sept 19th. Consequently, the 10-year government bond yield dropped to 6.89%, while the JISDOR remained relatively stable at around 16,300 per US dollar.

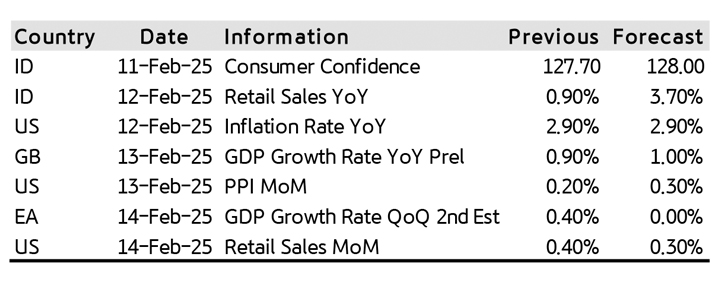

Weekly Highlight on Economic Indicators

Our Take:The stock market's significant downturn led to losses in our equity and balanced funds. But, our fixed income fund benefited on the bond market rally, exceeding the performance of comparable funds.

Valbury Prime Dynamic Equity decreased by 3.98% (BM: -3.14%), Valbury Investasi Berimbang decreased by 3.71% (BM: -1.34%). On the other hand, Valbury Stable Growth Fund increased by 0.98% (BM: 0.52%) and Valbury Money Market I increased by 0.10% (BM: 0.10%).

Low inflation contributed to Bank Indonesia's (BI) surprise interest rate reduction last month. While this week's data may offer some insights, the direction of BI's policy at next week's meeting remains uncertain.

The recommendation for investment to our investors (in order) :

Fixed Income Fund > Money Market Fund > Balanced Fund > Equity Fund.

Author : KBVAM Investment Team

DISCLAIMER :INVESTMENT THROUGH MUTUAL FUNDS CONTAINS RISKS. PROSPECTIVE INVESTORS MUST READ AND UNDERSTAND THE PROSPECTUS BEFORE DECIDING TO INVEST THROUGH MUTUAL FUNDS. PAST PERFORMANCE DOES NOT REFLECT FUTURE PERFORMANCE.This document was prepared based on information from reliable sources by PT KB Valbury Asset Management. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising, whether against or suffered by any person or party and in any way deemed to be a result of actions taken on the basis of all or part of this document.

Weekly Insight

Uncertainty

04 February 2025Weekly Insight

Uncertainty

04 February 2025

Global MarketsThe emergence of Deepseek triggered US market fluctuations earlier this week, but investor confidence has since rebounded seeing limited potential for the Chinese AI startup to affect the "Magnificent Seven's" performance. Despite this, S&P500 fall by 1% over the week, due to concerns about tariffs imposed on Mexico and Canada.

In other news, the Fed decided to hold interest rates steady at 4.5% as expected and indicated that stalled progress toward lower inflation warranted a patient approach. This decision led to a rise in the US dollar, reaching 108.22.

Major Asian stock exchanges were closed for the holidays. During the shortened trading week, the Japan Nikkei 225 fell by 0.90%, the Korea KOSPI dropped by 0.77%, and the Singapore STI rose by 1.36%.

Indonesian MarketsIn the two weeks following Bank Indonesia's surprising rate cut, the rupiah has remained relatively stable, though not without some fluctuations. The 10-year government bond yield closed last week at 6.97%, and the rupiah ended the week at 16,312 against the US dollar. The JCI, however, experienced high volatility in just two trading days last week, declining by 0.79%.

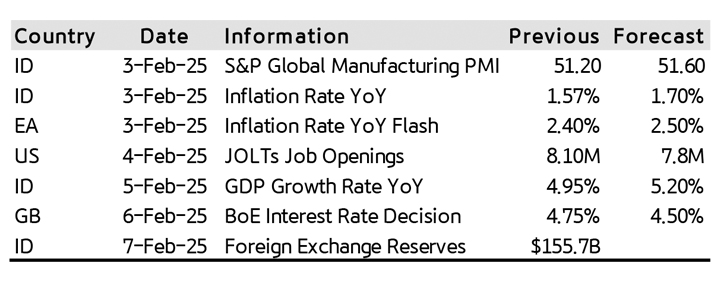

Weekly Highlight on Economic Indicators

Our Take:We felt the impact of this week's market volatility on our funds. Valbury Prime Dynamic Equity decreased by 0.73% (BM: -0.42%), Valbury Investasi Berimbang decreased by 0.74% (BM: -0.15%). On the other hand, Valbury Money Market I increased by 0.09% (BM: 0.09%) and Valbury Stable Growth Fund increased by 0.01% (BM: 0.04%).

Going forward, the US tariff policy is expected to have repercussions beyond the directly affected countries, impacting the global market. Given the uncertainty surrounding its implementation, we anticipate continued market volatility.

The recommendation for investment to our investors (in order) :

Fixed Income Fund > Balanced Fund > Equity Fund > Money Market Fund.

Author : KBVAM Investment Team

DISCLAIMER :INVESTMENT THROUGH MUTUAL FUNDS CONTAINS RISKS. PROSPECTIVE INVESTORS MUST READ AND UNDERSTAND THE PROSPECTUS BEFORE DECIDING TO INVEST THROUGH MUTUAL FUNDS. PAST PERFORMANCE DOES NOT REFLECT FUTURE PERFORMANCE.This document was prepared based on information from reliable sources by PT KB Valbury Asset Management. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising, whether against or suffered by any person or party and in any way deemed to be a result of actions taken on the basis of all or part of this document.

Latest Daily Market Wrap

Daily Market Wrap

December 20, 2024

20 December 2024Daily Market Wrap

December 20, 2024

20 December 2024NEWS

- The Bank of Japan kept its benchmark interest rate at 0.25% and the Bank of England also held its benchmark interest rate at 4.75%.

- Japan's core CPI in November recorded an increase of 2.7% YoY, above the estimate of 2.6%.

- Jobless claims in the United States based on the publication of December 14 were recorded at 220 thousand, below the estimate of 230 thousand.

MARKET UPDATE

- Indonesian stock market weakened with JCI declining by 1.84%.

- The biggest contributors: BYAN (1.50%), AMMN (1.13%), PGEO (7.22%)

- Biggest weakening contribution: BMRI (-2.58%), TPIA (-3.62%), BBCA (-1.28%)

- Indonesian bond market weakened with ICBI declining by 0.05%.

- The 10-year government bond yield rose to 7.08% from 7.07%.

- Rupiah exchange rate against US dollar weakened to IDR16,277/USD from IDR16,100/USD.

- Indonesia's 5-year CDS rose to 77.27 from 75.47.

Source : Bloomberg, Infovesta --- DISCLAIMER : INVESTMENT IN MUTUAL FUNDS INVOLVES RISKS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. BEFORE INVESTING, PLEASE CAREFULLY READ AND UNDERSTAND THE PROSPECTUS. This document was prepared by PT KB Valbury Asset Management based on information from reliable sources. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising from actions taken based on this document, whether suffered by any person or party.

Daily Market Wrap

December 19, 2024

19 December 2024Daily Market Wrap

December 19, 2024

19 December 2024NEWS

- Bank Indonesia decided to maintain interest rates at 6.00% with a focus on strengthening the stability of the Rupiah exchange rate. (Bank Indonesia)

- The Fed cut its benchmark interest rate by 25bps with a target range of 4.25%-4.50%.

- Dollar index jumped significantly to the highest level since November 2022 after the Fed announcement.

MARKET UPDATE

- The Indonesian stock market weakened with the JCI declining by 0.70%.

- The biggest contributors: BREN (1.99%), ADRO (3.19%), CUAN (3.95%)

- Biggest weakening contribution: BMRI (-2.10%), BYAN (-2.32%), BBCA (-1.01%)

- Indonesian bond market weakened with ICBI declining by 0.03%.

- The 10-year government bond yield rose to 7.07% from 7.06%.

- Rupiah exchange rate against US dollar weakened to IDR16,100/USD from IDR16,050/USD.

- Indonesia's 5-year CDS rose to 75.47 from 73.72.

Source : Bloomberg, Infovesta --- DISCLAIMER : INVESTMENT IN MUTUAL FUNDS INVOLVES RISKS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. BEFORE INVESTING, PLEASE CAREFULLY READ AND UNDERSTAND THE PROSPECTUS. This document was prepared by PT KB Valbury Asset Management based on information from reliable sources. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising from actions taken based on this document, whether suffered by any person or party.

Daily Market Wrap

December 18, 2024

18 December 2024Daily Market Wrap

December 18, 2024

18 December 2024NEWS

- Japan's November exports recorded an increase of 3.8% YoY, above the estimate of 2.5%.

- November US Retail Sales recorded an increase of 0.7% MoM, above the estimate of 0.6%.

- US Industrial Production in November recorded a decline of 0.1% MoM, below estimates of a 0.3% increase.

MARKET UPDATE

- Indonesian stock market weakened with JCI declining by 1.39%.

- The biggest contributors: BREN (4.45%), DSSA (1.89%), CUAN (1.88%)

- Biggest weakening contribution: BBRI (-2.35%), BBCA (-1.98%), BMRI (-2.06%)

- Indonesian bond market weakened with ICBI declining by 0.06%.

- The 10-year government bond yield fell to 7.06% from 7.07%.

- The Rupiah exchange rate against the US dollar weakened to IDR16,050/USD from IDR16,019/USD.

- Indonesia's 5-year CDS fell slightly to 73.72 from 73.77.

Source : Bloomberg, Infovesta --- DISCLAIMER : INVESTMENT IN MUTUAL FUNDS INVOLVES RISKS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. BEFORE INVESTING, PLEASE CAREFULLY READ AND UNDERSTAND THE PROSPECTUS. This document was prepared by PT KB Valbury Asset Management based on information from reliable sources. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising from actions taken based on this document, whether suffered by any person or party.

Daily Market Wrap

November 29, 2024

29 November 2024Daily Market Wrap

November 29, 2024

29 November 2024NEWS

- The government agreed to reduce airfares for domestic flights by 10% over the Christmas and New Year period.

- Japan's industrial output increased by 3.0%, below the estimate of 4.0%.

- Bond sales in Europe reached €1.705 trillion, breaking the annual record.

MARKET UPDATE

- Indonesian stock market weakened with JCI declining by 0.63%.

- The largest weakening contributors: ADRO (-24.80%), BBRI (-1.59%), TPIA (-2.44%)

- Biggest supporting contribution: AMMN (1.65%), BMRI (0.78%), BBNI (1.52%)

- The Indonesian bond market rallied with an increase in ICBI by 0.11%.

- The 10-year government bond yield fell to 6.90% from 6.92%.

- The Rupiah exchange rate against the US dollar strengthened to IDR 15,864/USD from IDR 15,930/USD.

- Indonesia's 5-year CDS fell to 75.28 from 75.34.

Source : Bloomberg, Infovesta --- DISCLAIMER : INVESTMENT IN MUTUAL FUNDS INVOLVES RISKS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. BEFORE INVESTING, PLEASE CAREFULLY READ AND UNDERSTAND THE PROSPECTUS. This document was prepared by PT KB Valbury Asset Management based on information from reliable sources. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising from actions taken based on this document, whether suffered by any person or party.

Latest Publication

Publication

Having Fund with Telkom University by MNC Securities & KB Valbury AM

02 November 2024Publication

Having Fund with Telkom University by MNC Securities & KB Valbury AM

02 November 2024MNC Sekuritas dan KB Valbury AM Gandeng Mahasiswa Universitas Telkom Belajar Investasi Reksa Dana

BANDUNG, iNews.id - MNC Sekuritas merupakan perusahaan sekuritas yang aktif dan konsisten dalam menggelar kegiatan edukasi pasar modal untuk menciptakan investor yang berkualitas.

Salah satu bukti komitmen pengembangan investor pasar modal Tanah Air adalah konsistensi Perseroan dalam melakukan edukasi pasar modal, termasuk dalam rangka Bulan Inklusi Keuangan (BIK) dan Gerakan Nasional Cerdas Keuangan (GENCARKAN) MNC Sekuritas bersama KB Valbury Asset Management kembali berkolaborasi dalam menggelar edukasi reksa dana dalam rangkaian acara Having Fund 2024.

Kali ini edukasi dilaksanakan di Telkom University, Bandung pada Kamis (13/10/2024). Pemaparan materi disampaikan oleh General Manager KB Valbury Asset Management Dede Surjadi dan Senior Marketing Mutual Fund MNC Sekuritas Wesly Andri.

General Manager KB Valbury Asset Management Dede Surjadi mengatakan bahwa saat ini para mahasiswa ataupun karyawan yang baru mulai bekerja, harus mengenal dan paham mengenai investasi.

Hal ini diperlukan agar daya beli yang dimiliki tidak tergerus oleh inflasi dengan adanya imbal hasil yang optimal dengan risiko yang terukur.

“Untuk jangka panjang, pemahaman investasi sangat diperlukan untuk mempersiapkan kebebasan finansial bagi setiap individu di masa depan,” ujar Dede.

Wakil Dekan I Bidang Akademik Fakultas Ekonomi dan Bisnis Telkom University Deannes Isynuwardhana, PhD dalam keterangannya menyampaikan bahwa mahasiswa dan mahasiswi perlu untuk diberikan literasi dan informasi mengenai pasar modal.

“Harapannya kami ingin kegiatan seperti ini terus berlanjut sehingga mahasiswa-mahasiswi dapat memahami seperti apa pentingnya pasar modal,” tutur dia.

Nikmati layanan investasi saham dan reksa dana dari #MNCSekuritas dengan segera unduh aplikasi MotionTrade dan jelajahi seamless experience.

Aplikasi MotionTrade dapat diunduh di Google PlayStore dan Apple AppStore dengan link unduh onelink.to/motiontrade. MNC Sekuritas, Invest with The Best!

Editor: Puti Aini Yasmin

---

Artikel ini telah diterbitkan di halaman inews.id pada Sabtu, 02 November 2024 - 11:44:00 WIB oleh Tim iNews.id dengan judul "MNC Sekuritas dan KB Valbury AM Gandeng Mahasiswa Universitas Telkom Belajar Investasi Reksa Dana". Untuk selengkapnya kunjungi:

https://www.inews.id/finance/bisnis/mnc-sekuritas-dan-kb-valbury-am-gandeng-mahasiswa-universitas-te...

Publication

Having Fund with Mercu Buana University by MNC Securities & KB Valbury AM

30 October 2024Publication

Having Fund with Mercu Buana University by MNC Securities & KB Valbury AM

30 October 2024JAKARTA - MNC Sekuritas merupakan perusahaan sekuritas yang aktif dan konsisten dalam menggelar kegiatan edukasi pasar modal untuk menciptakan investor yang berkualitas. Salah satu bukti komitmen pengembangan investor pasar modal Tanah Air adalah konsistensi Perseroan dalam melakukan edukasi pasar modal, termasuk dalam rangka Bulan Inklusi Keuangan (BIK) dan Gerakan Nasional Cerdas Keuangan (GENCARKAN).

MNC Sekuritas bersama KB Valbury Asset Management memberikan edukasi reksa dana kepada lebih dari 100 mahasiswa Universitas Mercu Buana , Kampus Menteng pada Selasa (29/10/2024). Adapun materi edukasi disampaikan oleh General Manager KB Valbury Asset Management Dede Surjadi dan Head of Mutual Fund MNC Sekuritas Agustina Endah.

Dalam pemaparannya, General Manager KB Valbury Asset Management Dede Surjadi menjelaskan bahwa berinvestasi berbeda dengan menabung. Uang kehilangan nilainya seiring dengan berjalannya waktu karena dipengaruhi oleh inflasi. Untuk melawan inflasi maka perlu berinvestasi, khususnya investasi pada reksa dana yang dikelola oleh para profesional.

“Mulai disiplin menyisihkan uang untuk berinvestasi reksa dana, bahkan berinvestasi reksa dana bisa dengan harga yang terjangkau di aplikasi MotionTrade, dengan imbal hasil yang lumayan dan risiko yang terukur!” jelasnya.

Kepala Galeri Investasi Universitas Mercu Buana Menteng Riska Rosdiana dalam sambutannya menyampaikan terima kasih kepada MNC Sekuritas dan KB Valbury Asset Management. Menurutnya, acara ini adalah sarana agar mahasiswa dapat mengelola keuangan melalui reksa dana, yang tentunya sangat cocok untuk investor pemula.

"Selamat mengikuti seminar ini, saya mewakili jajaran Universitas Mercu Buana Menteng berharap acara ini dapat berjalan dengan lancar. Kami berharap seminar ini bisa memberikan inspirasi bagi mahasiswa untuk lebih aktif dalam berinvestasi pasar modal," ucap Riska.

Nikmati layanan investasi saham dan reksa dana dari #MNCSekuritas dengan segera unduh aplikasi MotionTrade dan jelajahi seamless experience. Aplikasi MotionTrade dapat diunduh di Google PlayStore dan Apple AppStore dengan link unduh onelink.to/motiontrade.

MNC Sekuritas, Invest with The Best!

---

Artikel ini telah diterbitkan di halaman SINDOnews.com pada Rabu, 30 Oktober 2024 - 11:10 WIB oleh Anto Kurniawan dengan judul "MNC Sekuritas dan KB Valbury AM Gelar Edukasi Reksa Dana di Universitas Mercu Buana". Untuk selengkapnya kunjungi:

https://ekbis.sindonews.com/read/1480639/178/mnc-sekuritas-dan-kb-valbury-am-gelar-edukasi-reksa-dan...

Publication

Having Fund with STIE Tri Bhakti by MNC Securities & KB Valbury AM

25 October 2024Publication

Having Fund with STIE Tri Bhakti by MNC Securities & KB Valbury AM

25 October 2024JAKARTA - MNC Sekuritas merupakan perusahaan sekuritas yang aktif dan konsisten dalam menggelar kegiatan edukasi pasar modal untuk menciptakan investor yang berkualitas. Salah satu bukti komitmen pengembangan investor pasar modal Tanah Air adalah konsistensi Perseroan dalam melakukan edukasi pasar modal, termasuk dalam rangka Bulan Inklusi Keuangan (BIK) dan Gerakan Nasional Cerdas Keuangan (GENCARKAN).

MNC Sekuritas dan KB Valbury Asset Management menggelar kegiatan edukasi reksa dana "Having Fund 2024" di STIE Tri Bhakti pada Kamis (24/10/2024). Materi edukasi disampaikan langsung oleh Direktur KB Valbury Asset Management Dede Surjadi dan Senior Marketing Mutual Fund MNC Sekuritas Wesly Andri. Antusiasme peserta terlihat dari ±150 mahasiswa yang turut hadir mengikuti kegiatan ini.

Direktur KB Valbury Asset Management, Dede Surjadi mengatakan, bahwa para mahasiswa dan juga para pekerja muda Indonesia perlu pemahaman yang tepat mengenai investasi di pasar modal Indonesia, khususnya investasi pada reksa dana.

“Melalui acara Having Fund 2024 ini, kami memaparkan pentingnya disiplin dan komitmen dalam berinvestasi dengan nilai yang masih terjangkau oleh para investor pemula. Kami memperkenalkan pula produk reksa dana yang cocok untuk tujuan tersebut, dimana produk tersebut dapat diperoleh melalui MotionTrade dari MNC Sekuritas,” ujar Dede.

Rektor STIE Tri Bhakti Drs.Widayatmoko, MM., M.Ikom dalam keterangan tertulisnya menerangkan, bahwa kolaborasi antara MNC Sekuritas dan STIE Tri Bhakti dilakukan untuk terus mengedukasi dan meningkatkan literasi pasar modal.

"Kami berharap agar mahasiswa lebih mengenal berbagai instrumen pasar modal, sehingga dapat membuka akses dan kesempatan mahasiswa untuk menjadi investor di pasar modal," tulis Widayatmoko.

Nikmati layanan investasi saham dan reksa dana dari #MNCSekuritas dengan segera unduh aplikasi MotionTrade dan jelajahi seamless experience. Aplikasi MotionTrade dapat diunduh di Google PlayStore dan Apple AppStore dengan link unduh onelink.to/motiontrade .

MNC Sekuritas, Invest with The Best!

---

Artikel ini telah diterbitkan di halaman SINDOnews.com pada Kamis, 24 Oktober 2024 - 16:27 WIB oleh Anto Kurniawan dengan judul "Mahasiswa STIE Tri Bhakti Antusias Ikuti Edukasi Having Fund oleh MNC Sekuritas & KB Valbury AM". Untuk selengkapnya kunjungi:

https://ekbis.sindonews.com/read/1477915/178/mahasiswa-stie-tri-bhakti-antusias-ikuti-edukasi-having....

Publication

PROMOTION. Invest & Win ! For Fresh Fund & Long-Term Investment

31 July 2024Publication

PROMOTION. Invest & Win ! For Fresh Fund & Long-Term Investment

31 July 2024

INVEST & WIN !The Longer, The Better

Periode Subscription : 1 August 2024 - 30 December 2024

1. Promotion for Fresh Fund

- Invest mutual fund in BRAVO during the subscription period with a minimum subscription of 20 MILLION RUPIAH.

- THE FIRST 20 PEOPLE will get a mutual fund unit participation bonus worth 100 THOUSAND RUPIAH.

2. Promotion for Long-Term Investment

- Investors who have AUM from the subscription period until the drawing date with a minimum AUM of 20 MILLION RUPIAH are entitled to participate in the draw.

- The draw will be held on the last trading day in 2025.

- 8 WINNERS of the lucky draw are entitled to a bonus unit participation worth 1 MILLION RUPIAH.

General requirements :

- Prizes are non-transferable or non-cashable.

- KB Valbury Asset Management's decision to determine the winner is final and cannot be contested.

- KB Valbury Asset Management can cancel the winner if the customer is proven to have committed fraud, or cannot be contacted.

*Other Terms & Conditions apply.