NEWS

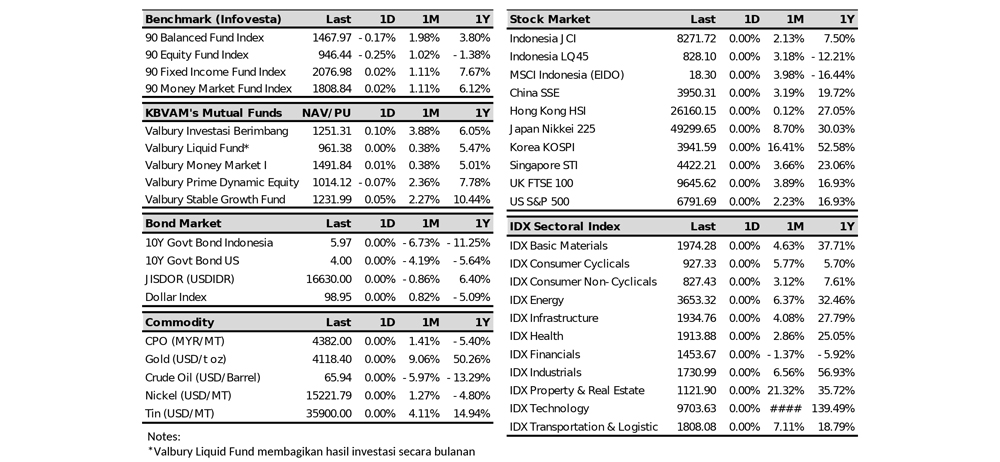

- United States: U.S. inflation in September rose 3.0% YoY (lower than the expected 3.1%), with core inflation stable at 3.0%. This reinforces market expectations that the Fed will cut interest rates by 25 bps at the FOMC meeting on October 28–29, 2025. U.S. Treasury yields were relatively stable at 4.00% for 10-year tenors, indicating investors' “wait and see” stance ahead of the Fed's decision.

- Europe: Tensions rose between the European Union and Russia after the ban on Russian gas imports, as part of pressure to end the war in Ukraine.

MARKET UPDATE

- The JCI closed at 8,271.7, down slightly by 0.03% due to profit-taking after hitting a record high of 8,351.06 on October 24. Foreign inflows were recorded at +IDR 1.2 trillion, mainly in BMRI (+IDR 449 billion) and ASII (+IDR 383 billion) shares.

- The yield on 10-year government bonds was stable at 5.99%, while the 5-year yield was at 5.40%. The trading volume of government bonds increased to IDR 25.3 trillion. The government issued Dim Sum Bonds worth IDR 13.7 trillion to diversify state budget financing.

- Bank Indonesia maintained the 7-Day RR Rate benchmark interest rate at 4.75%, citing low inflation and stable Rupiah.

Source : Bloomberg, Infovesta

---

DISCLAIMER :

INVESTMENT IN MUTUAL FUNDS INVOLVES RISKS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. BEFORE INVESTING, PLEASE CAREFULLY READ AND UNDERSTAND THE PROSPECTUS.

This document was prepared by PT KB Valbury Asset Management based on information from reliable sources. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising from actions taken based on this document, whether suffered by any person or party.

Latest Weekly Insight

Weekly Insight

Market Sentiment Shift

01 December 2025Weekly Insight

Market Sentiment Shift

01 December 2025

Global MarketsMarket sentiment in U.S. equities has turned more positive compared to the previous week, when concerns over high valuations—particularly in the technology sector—had weighed on performance. The shift to a more constructive sentiment was supported by growing optimism that the Federal Funds Rate could be cut at the upcoming FOMC meeting, reinforced by dovish remarks from several Federal Reserve officials and weakening U.S. economic data. Fed officials Mary Daly, Christopher Waller, and John Williams have all expressed support for a potential rate cut in December, citing a softening labor market.

Indonesian MarketsDomestically, equity market recorded positive performance, with the IDX80 index rising +0.81% last week and the JCI gaining +1.12%. Foreign investors booked a net purchase of IDR 991 billion in the equity market. Meanwhile, the BINDO bond index declined –0.36%, as the yield on 10-year government bonds increased from 6.18% to 6.31%. The rise in SRBI yields became a contributing factor to the pressure on the SBN market.

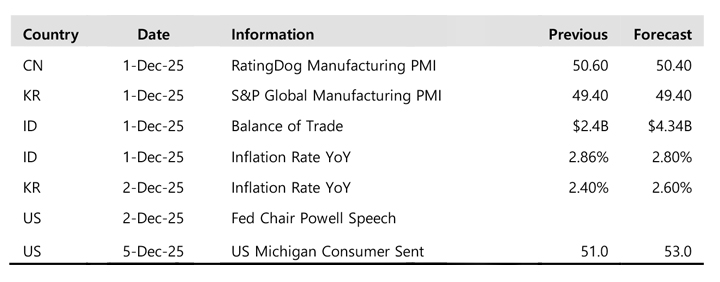

Weekly Highlight on Economic Indicators

Our Take:Given the increasing likelihood of a Fed rate cut and improving dovish sentiment, our equity portfolio is currently in a defensive stance as positive sentiment wanes. Meanwhile, we shift toward our duration (fixed income portfolio) as the 10-year SBN yield has climbed 13bps within a week, driven by higher SRBI yields and increased auction frequency from Bank Indonesia, which has tightened liquidity.

The recommendation for investment to our investors (in order):

Equity Fund > Fixed Income Fund > Balanced Fund > Money Market Fund.

Author : KBVAM Investment TeamSource: Bloomberg, Infovesta, Trading Economics

DISCLAIMER :INVESTMENT THROUGH MUTUAL FUNDS CONTAINS RISKS. PROSPECTIVE INVESTORS MUST READ AND UNDERSTAND THE PROSPECTUS BEFORE DECIDING TO INVEST THROUGH MUTUAL FUNDS. PAST PERFORMANCE DOES NOT REFLECT FUTURE PERFORMANCE.This document was prepared based on information from reliable sources by PT KB Valbury Asset Management. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising, whether against or suffered by any person or party and in any way deemed to be a result of actions taken on the basis of all or part of this document.

Weekly Insight

Upside Gains

27 October 2025Weekly Insight

Upside Gains

27 October 2025

Global MarketsGlobal financial markets moved fluctuatively amid a combination of U.S.–China–Russia geopolitical tensions and expectations of global monetary easing. The U.S. government announced plans to limit software exports to China, but tensions eased after both countries signaled a preliminary agreement ahead of the Trump–Xi meeting scheduled for October 30, 2025. In Europe, the 10-year German and French bond yields climbed to 2.63% and 3.43%, respectively, while the U.K. gilt yield fell to 4.43% following softer-than-expected inflation data, reinforcing expectations of a more dovish Bank of England.

Indonesian MarketsDomestically, Bank Indonesia (BI) surprised the market by maintaining its policy rate at 4.75%, defying expectations of a 25-bps cut to 4.50%. BI emphasized that inflation remains within its 2.5% ±1% target range, with its current stance focused on Rupiah stability and supporting monetary transmission.

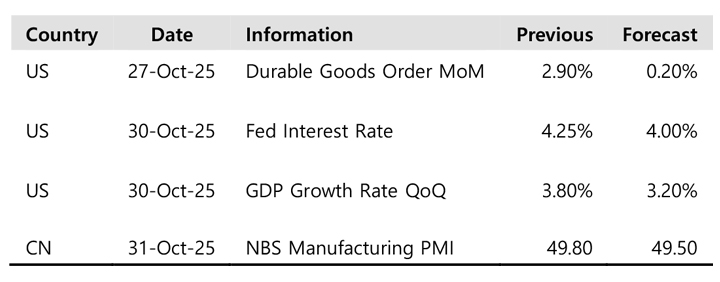

Weekly Highlight on Economic Indicators

Our Take:Equities: Momentum is likely to remain positive toward year end 2025. The JCI could test 8,350 – 8,425 if the Fed confirms a 25 bps rate cut and BI maintains liquidity support. Bonds: The domestic bond market may trade sideways to slightly bullish. A Fed cut and lower inflation expectations should compress yields gradually toward 5.80 % (10-year). However, profit-taking and supply from government issuance will cap upside gains.

The recommendation for investment to our investors (in order):

Fixed Income Fund > Equity Fund > Balanced Fund > Money Market Fund.

Author : KBVAM Investment TeamSource: Bloomberg, Infovesta, Trading Economics

DISCLAIMER :INVESTMENT THROUGH MUTUAL FUNDS CONTAINS RISKS. PROSPECTIVE INVESTORS MUST READ AND UNDERSTAND THE PROSPECTUS BEFORE DECIDING TO INVEST THROUGH MUTUAL FUNDS. PAST PERFORMANCE DOES NOT REFLECT FUTURE PERFORMANCE.This document was prepared based on information from reliable sources by PT KB Valbury Asset Management. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising, whether against or suffered by any person or party and in any way deemed to be a result of actions taken on the basis of all or part of this document.

Weekly Insight

Under Pressure

20 October 2025Weekly Insight

Under Pressure

20 October 2025

Global MarketsThe Federal Reserve: Market expectations have strengthened for two additional rate cuts in 2025—a likely 25 bps cut in October and another in December—following dovish remarks from Chair Jerome Powell and Governor Christopher Waller, who both emphasized the need for a gradual easing cycle. From Europe, Government bond yields declined amid improved political sentiment in France (postponement of pension reforms) and more contained inflation expectations. Asia China-US Relations: Trade tensions have resurfaced. The planned Trump–Xi Jinping meeting later this month will focus on the cumulative 145% tariffs imposed on Chinese goods, which markets hope could be moderated.

Indonesian MarketsDomestically, Indonesia’s 3Q25 GDP growth is expected to remain solid around 4.8–4.9% YoY, supported by household consumption and nickel exports. Bank Indonesia (BI) Policy Rate currently stands at 4.75%, following five consecutive cuts since early 2025 (from 5.50%). Markets are split between expectations of a 25 bps cut to 4.50% or a hold at 4.75% in this week’s Board of Governors Meeting. Rupiah slightly weakened to IDR 16,590/USD, in line with global USD strength and foreign outflows.

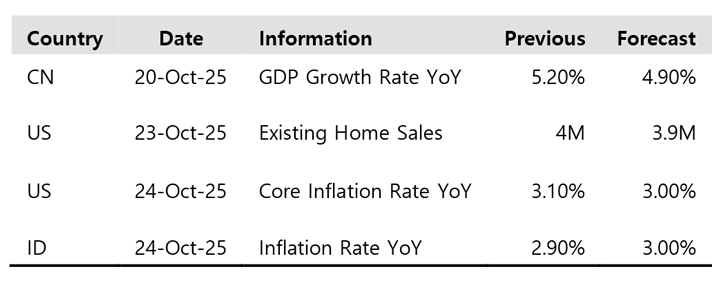

Weekly Highlight on Economic Indicators

Our Take:JCI fell sharply below 8,000 last week, driven by foreign net outflows of IDR 3 trillion, rising geopolitical risk in Gaza, and concerns over large conglomerate stocks. From bond market, The 10 year benchmark yield fell significantly to 5.96% (from 6.12% last week), its lowest level since January 2021 due to abundant domestic liquidity and BI’s easing bias helped keep yields anchored.

The recommendation for investment to our investors (in order):

Fixed Income Fund > Equity Fund > Balanced Fund > Money Market Fund.

Author : KBVAM Investment TeamSource: Bloomberg, Infovesta, Trading Economics

DISCLAIMER :INVESTMENT THROUGH MUTUAL FUNDS CONTAINS RISKS. PROSPECTIVE INVESTORS MUST READ AND UNDERSTAND THE PROSPECTUS BEFORE DECIDING TO INVEST THROUGH MUTUAL FUNDS. PAST PERFORMANCE DOES NOT REFLECT FUTURE PERFORMANCE.This document was prepared based on information from reliable sources by PT KB Valbury Asset Management. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising, whether against or suffered by any person or party and in any way deemed to be a result of actions taken on the basis of all or part of this document.

Weekly Insight

Trade Tension Impact

13 October 2025Weekly Insight

Trade Tension Impact

13 October 2025

Global MarketsGeopolitical tensions between the U.S. and China escalated, following President Donald Trump’s threat to impose an additional 100% tariff on Chinese goods effective November 1, 2025. In response, China announced export restrictions on rare earth metals, intensifying fears of a renewed trade war. This pushed investors toward safe-haven assets, particularly U.S. Treasuries. Federal Reserve officials, including Christopher Waller and Mary Daly, signaled cautious support for further monetary easing while highlighting early signs of labor market softening.

Indonesian MarketsDomestically, Indonesia’s local currency bond market strengthened as global risk sentiment improved and domestic liquidity remained abundant. Government bond yields declined across the curve, with the 10-year benchmark yield dropping 20–21 bps to around 6.09–6.12%, and the 5-year yield down 9 bps to 5.38%. The Jakarta Composite Index (JCI) rose 1.7% WoW to a record 8,258, led by conglomerate and commodity stocks. The Rupiah slightly weakened to IDR 16,570/USD, remaining broadly stable as Bank Indonesia was expected to provide liquidity support via open market operations.

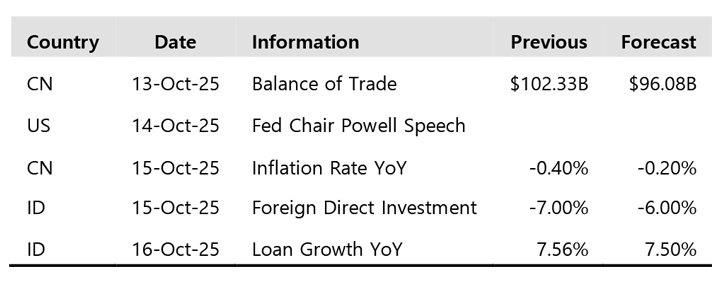

Weekly Highlight on Economic Indicators

Our Take:The past week was dominated by renewed U.S.–China trade tensions, a prolonged U.S. government shutdown, and mounting expectations for Fed rate cuts, all of which drove a global bond rally. In Indonesia, stable domestic liquidity, robust auction demand, and controlled inflation helped sustain the bond market rally and maintain positive sentiment in equities, despite ongoing foreign outflows from the banking sector.

The recommendation for investment to our investors (in order):

Fixed Income Fund > Equity Fund > Balanced Fund > Money Market Fund.

Author : KBVAM Investment TeamSource: Bloomberg, Infovesta, Trading Economics

DISCLAIMER :INVESTMENT THROUGH MUTUAL FUNDS CONTAINS RISKS. PROSPECTIVE INVESTORS MUST READ AND UNDERSTAND THE PROSPECTUS BEFORE DECIDING TO INVEST THROUGH MUTUAL FUNDS. PAST PERFORMANCE DOES NOT REFLECT FUTURE PERFORMANCE.This document was prepared based on information from reliable sources by PT KB Valbury Asset Management. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising, whether against or suffered by any person or party and in any way deemed to be a result of actions taken on the basis of all or part of this document.

Latest Daily Market Wrap

Daily Market Wrap

December 18, 2025

18 December 2025Daily Market Wrap

December 18, 2025

18 December 2025NEWS

- America : Wall Street closed lower with broad pressure on technology stocks, with the S&P 500 down 1.16% and the Nasdaq down 1.81%, while the Dow Jones was more stable at -0.47% thanks to the defensive sector. The 10-year US Treasury yield rose to 4.15% amid expectations that the Fed will maintain high interest rates for longer.

- Europe : Markets moved flat, with the STOXX 600 down slightly by 0.01%. Weakness in tech stocks weighed on the market amid concerns over high valuations due to AI euphoria holding back market momentum, although the basic resources sector posted solid performance.

- Asia : Asian stock markets moved mixed (Nikkei +0.26%, Shanghai +1.19%, Hang Seng +0.92%, Kospi +1.43%, MSCI -0.37% and JCI -0.11%). Movements were influenced by anticipation of US inflation data, uncertainty over Beijing's stimulus, and anticipation of the BOJ's decision, causing investors to be defensive. Meanwhile, Asian bonds remained attractive as defensive assets amid limited risk sentiment.

- The JCI corrected by -0.11% to 8,677, supported by moderate volume and slightly negative market breadth. Profit taking ahead of year-end window dressing and sector rotation limited intraday volatility. Monetary sentiment was fairly conducive after BI maintained the BI Rate at 4.75%, with focus on Rupiah stabilitzation and liquidity transmission. However, foreign outflow pressure following the global rate path decision held back momentum, keeping the index moving within a limited range.

- Bond Market: The 10-year SUN yield fell to 6.12% (-6 bps), signaling stronger prices and interest in longer tenors. Sentiment was supported by expectations of a more dovish global monetary policy, stable domestic inflation, and BI's conservative stance in maintaining interest rates and the rupiah.

Source : Bloomberg, Infovesta --- DISCLAIMER : INVESTMENT IN MUTUAL FUNDS INVOLVES RISKS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. BEFORE INVESTING, PLEASE CAREFULLY READ AND UNDERSTAND THE PROSPECTUS. This document was prepared by PT KB Valbury Asset Management based on information from reliable sources. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising from actions taken based on this document, whether suffered by any person or party.

Daily Market Wrap

October 30, 2025

30 October 2025Daily Market Wrap

October 30, 2025

30 October 2025NEWS

- United States: The Fed lowered the Fed Funds Rate by 25 bps to 3.75%–4.00%, but Jerome Powell signaled a hawkish stance that further cuts in December 2025 remain uncertain. The market viewed this decision as a “dovish cut but hawkish tone,” causing US Treasury yields to rise 8–11 bps across all tenors (2Y–30Y) and the US Dollar to strengthen.

- China: President Donald Trump stated that he would lower fentanyl tariffs on China ahead of his meeting with Xi Jinping, signaling potential improvement in trade relations. China demanded tariff policy stability, technology access, and reciprocal cooperation.

- The JCI closed up +0.91% at 8,166.2 yesterday, supported by foreign net purchases of Rp3.7 trillion. However, the risk of a short-term correction has increased due to the Fed's hawkish stance going forward.

- The rupiah bond market weakened slightly, with the 10-year yield rising 1 bps to 6.01% in line with the increase in global yields. Trading volume increased significantly to Rp31.5 trillion from Rp21 trillion the previous day — signaling high activity ahead of the end of the month.

Source : Bloomberg, Infovesta --- DISCLAIMER : INVESTMENT IN MUTUAL FUNDS INVOLVES RISKS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. BEFORE INVESTING, PLEASE CAREFULLY READ AND UNDERSTAND THE PROSPECTUS. This document was prepared by PT KB Valbury Asset Management based on information from reliable sources. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising from actions taken based on this document, whether suffered by any person or party.

Daily Market Wrap

October 14, 2025

14 October 2025Daily Market Wrap

October 14, 2025

14 October 2025NEWS

- United States: US stock indices (DJIA +1.29%, S&P 500 +1.56%, Nasdaq +2.21%) rose sharply, triggered by President Donald Trump's statement that tensions between the US and China would ease after an agreement on rare earth minerals and shipping fees was expected to be reached soon.

- European markets rose (Stoxx600 +0.44%, DAX +0.60%) after Trump announced the end of the Gaza war during his visit to Tel Aviv and the release of prisoners between Israel and Hamas.

- Asian markets tended to weaken due to US tariff policies and weakening confidence in US-China bilateral relations.

- The JCI closed down 0.37% to 8,227.20 on October 13, 2025, after posting strong performance in the previous quarter (+16.2% YTD). The LQ45 fell deeper (-0.71%), indicating greater pressure on large-cap stocks. Total transaction value was recorded at IDR 27.4 trillion, with foreign investors posting a net buy of IDR 2.3 trillion.

- The 10-year SUN yield fell to 6.10% (vs. 6.35% a week earlier) as Rp6.43 trillion flowed into the SBN market. The rupiah strengthened to Rp16,560/USD from Rp16,610/USD previously, supported by positive domestic sentiment and expectations of global interest rate cuts.

Source : Bloomberg, Infovesta --- DISCLAIMER : INVESTMENT IN MUTUAL FUNDS INVOLVES RISKS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. BEFORE INVESTING, PLEASE CAREFULLY READ AND UNDERSTAND THE PROSPECTUS. This document was prepared by PT KB Valbury Asset Management based on information from reliable sources. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising from actions taken based on this document, whether suffered by any person or party.

Daily Market Wrap

December 20, 2024

20 December 2024Daily Market Wrap

December 20, 2024

20 December 2024NEWS

- The Bank of Japan kept its benchmark interest rate at 0.25% and the Bank of England also held its benchmark interest rate at 4.75%.

- Japan's core CPI in November recorded an increase of 2.7% YoY, above the estimate of 2.6%.

- Jobless claims in the United States based on the publication of December 14 were recorded at 220 thousand, below the estimate of 230 thousand.

MARKET UPDATE

- Indonesian stock market weakened with JCI declining by 1.84%.

- The biggest contributors: BYAN (1.50%), AMMN (1.13%), PGEO (7.22%)

- Biggest weakening contribution: BMRI (-2.58%), TPIA (-3.62%), BBCA (-1.28%)

- Indonesian bond market weakened with ICBI declining by 0.05%.

- The 10-year government bond yield rose to 7.08% from 7.07%.

- Rupiah exchange rate against US dollar weakened to IDR16,277/USD from IDR16,100/USD.

- Indonesia's 5-year CDS rose to 77.27 from 75.47.

Source : Bloomberg, Infovesta --- DISCLAIMER : INVESTMENT IN MUTUAL FUNDS INVOLVES RISKS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. BEFORE INVESTING, PLEASE CAREFULLY READ AND UNDERSTAND THE PROSPECTUS. This document was prepared by PT KB Valbury Asset Management based on information from reliable sources. PT KB Valbury Asset Management does not guarantee the accuracy, adequacy or completeness of the information and materials provided. PT KB Valbury Asset Management Indonesia is not responsible for any legal and financial consequences arising from actions taken based on this document, whether suffered by any person or party.

Latest Publication

Publication

PLAN OF AMENDMENT KIK & PROSPECTUS OF MUTUAL FUND KBVAM

01 December 2025Publication

PLAN OF AMENDMENT KIK & PROSPECTUS OF MUTUAL FUND KBVAM

01 December 2025ANNOUNCEMENT OF PLANNING TO CHANGE COLLECTIVE INVESTMENT CONTRACTS ("KIK") AND PROSPECTUS OF MUTUAL FUNDS MANAGED BY PT KB VALBURY ASSET MANAGEMENT

PT KB Valbury Asset Management, as Investment Manager of:

- VALBURY STABLE GROWTH FUND;

- VALBURY INVESTASI BERIMBANG FUND;

- VALBURY LIQUID FUND;

- VALBURY MONEY MARKET I FUND; and

- VALBURY PRIME DYNAMIC EQUITY FUND.

intends to announce planned changes to the Investment Cooperative Investment Fund (KIK) and Prospectus of KB VALBURY MUTUAL FUNDS, with the following details :

I. Planned changes to the Investment Cooperative Investment Fund (KIK) and Prospectus of KB VALBURY MUTUAL FUNDS

- Change of the Investment Manager's name from "PT Valbury Capital Management" to "PT KB Valbury Asset Management";

- Change of the name of KB VALBURY MUTUAL FUNDS in connection with the change of the Investment Manager's name as referred to in point 1) above;

- Additional information on the Auto-debit mechanism for periodic payments for Participation Unit purchases of KB VALBURY MUTUAL FUNDS by KB VALBURY MUTUAL FUNDS Unit Holders.

- Additional payment methods for purchasing Participation Units in VALBURY MUTUAL FUNDS by Unit Holders can be made through a Virtual Account;

- Additional information that payment for purchasing Participation Units in VALBURY MUTUAL FUNDS into VALBURY MUTUAL FUNDS accounts can be made by transfer via electronic means, including payment gateways and QRIS (Quick Response Code Indonesian Standard), as long as it complies with applicable laws and regulations;

- Updated correspondence addresses for the Investment Manager for all VALBURY MUTUAL FUNDS, except for the VALBURY LIQUID FUND.

- Changes to the Composition of the Board of Directors and Investment Management Team of the Investment Manager; and

- Adjustments to the provisions in the KIK and Prospectus to the Laws and Regulations of the Financial Services Authority ("POJK"), including the following:

- Law Number 4 of 2023, dated January 12, 2023, concerning the Development and Strengthening of the Financial Sector;

- OJK Regulation Number 17/POJK.04/2022, dated September 1, 2022, concerning the Guidelines for Investment Manager Conduct;

- OJK Regulation Number 4 of 2023, dated March 30, 2023, concerning the Second Amendment to OJK Regulation 23/POJK.04/2016 concerning Mutual Funds in the Form of Collective Investment Contracts;

- OJK Regulation Number 8 of 2023, dated June 14, 2023, concerning the Implementation of Anti-Money Laundering, Counter-Terrorism Financing, and Counter-Proliferation of Weapons of Mass Destruction Programs in the Financial Services Sector;

- OJK Regulation Number 22 of 2023, dated December 22, 2023, concerning OJK Regulation Concerning Consumer and Community Protection in the Financial Services Sector;

- OJK Regulation Number 22/POJK.04/2017 dated June 21, 2017, concerning Securities Transaction Reporting; and

- OJK Regulation Number 33 of 2024 dated December 19, 2024, concerning the Development and Strengthening of Investment Management in the Capital Market;

- OJK Regulation Number 56/POJK.04/2020 dated December 3, 2020, concerning Mutual Fund Reporting and Accounting Guidelines (specifically for VALBURY INVESTMENT BALANCED MUTUAL FUNDS and VALBURY MONEY MARKET I MUTUAL FUNDS);

- OJK Regulation Number 31/POJK.07/2020 dated April 22, 2020, concerning the Provision of Consumer and Public Services in the Financial Services Sector by the Financial Services Authority (specifically for VALBURY INVESTMENT BALANCED MUTUAL FUNDS and VALBURY MONEY MARKET I MUTUAL FUNDS);

- OJK Regulation Number 18/POJK.07/2018 dated September 10, 2018 concerning Consumer Complaints Services in the Financial Services Sector (specifically for VALBURY INVESTMENT BALANCED MUTUAL FUNDS and VALBURY MONEY MARKET I MUTUAL FUNDS); and

- OJK Regulation Number 61/POJK.07/2020 dated December 14, 2020 concerning Alternative Dispute Resolution Institutions in the Financial Services Sector (specifically for VALBURY INVESTMENT BALANCED MUTUAL FUNDS and VALBURY MONEY MARKET I MUTUAL FUNDS).

Publication

Resolving Investment Disputes in the Right Way: Getting to Know LAPS SJK

04 November 2025Publication

Resolving Investment Disputes in the Right Way: Getting to Know LAPS SJK

04 November 2025As part of our commitment to transparency and investor protection, we support dispute resolution mechanisms through the Financial Services Sector Alternative Dispute Resolution Institution (LAPS SJK).

LAPS SJK is an independent institution licensed and supervised by the Financial Services Authority (OJK), which functions to assist in the fair, swift, and out-of-court resolution of disputes between consumers and financial service providers—including investment management companies.

The existence of LAPS SJK is regulated in OJK Regulation (POJK) Number 61/POJK.07/2020 concerning the Alternative Dispute Resolution Institution for the Financial Services Sector, which forms the legal basis for the implementation of non-litigation dispute resolution processes in the financial services industry.

Services Provided

- Mediation: dispute resolution by facilitating dialogue between disputing parties to reach a mutually beneficial agreement through a negotiation process between the disputing parties.

- Arbitration: resolution of civil disputes through an arbitrator's decision outside of the general court system based on an Arbitration Agreement made in writing by the disputing parties.

- Binding Opinions: Provision of professional views on differences in interpretation in the implementation of agreements, for example regarding: interpretation of unclear provisions; additions or changes to provisions related to the emergence of new circumstances; or regarding certain legal relationships of an agreement.

Through LAPS SJK, customers have an easily accessible and reliable dispute resolution channel, while companies can maintain their integrity, professionalism, and investor confidence.

For more information, visit the official website www.lapssjk.id.

Source : http://www.lapssjk.id

Publication

Cuan Challenge

09 July 2025Publication

Cuan Challenge

09 July 2025Program Terms & Conditions:

- Promotion applies to new, existing and KB group employees

- Customers who wish to participate in the CUAN CHALLENGE program are required to register in advance through the link available: bit.ly/joincuanchallenge

- For those who are interested in participating in the CUAN CHALLENGE program but are not yet KB Valbury Asset Management customers, they can open a mutual fund account online through BRAVO (https://bravo.valbury.co.id) or manually fill out a mutual fund account opening form before registering as a CUAN CHALLENGE program participant.

- Participants who have registered must make a subscription every month consecutively for 12 months, starting from the month when registering a minimum of Rp, 500,000, - (five hundred thousand rupiah).

- Products that are included in the CUAN CHALLENGE program are Mutual Fund Products: Valbury Money Market I

- Participants who do not make a subscription in 1 month or more during the regular investment period, will be disqualified.

- Participants who do not make redemptions and successfully complete the Cuan Challenge program for 12 months will get a participation unit bonus of Rp. 150,000 (one hundred and fifty thousand rupiah).

- The bonus will be given after each participant's periodic investment program ends in the form of mutual fund participation units (maximum 14 working days).

- Taxes on bonuses received by customers are borne by KB Valbury Asset Management in accordance with applicable tax regulations.

- Participants who have completed the Cuan Challenge program and have not made redemptions in the following 3 months will get an additional bonus of Rp.50,000 (fifty thousand rupiah).

- Prizes are non-transferable

- The decision of PT KB Valbury Asset Management (KBVAM) in determining the winner is absolute and cannot be contested.

- KBVAM has the right to disqualify and cancel the bonus if there are indications of misuse by participants and / or violations of the terms and conditions.

- KBVAM may change or terminate the promo and terms and conditions at any time without prior notice.

- This policy is effective as of August 01, 2025 and if there are any changes will be informed further.

- Provisions that have not been listed in this circular will be regulated later.

Publication

Having Fund with Telkom University by MNC Securities & KB Valbury AM

02 November 2024Publication

Having Fund with Telkom University by MNC Securities & KB Valbury AM

02 November 2024MNC Sekuritas dan KB Valbury AM Gandeng Mahasiswa Universitas Telkom Belajar Investasi Reksa Dana

BANDUNG, iNews.id - MNC Sekuritas merupakan perusahaan sekuritas yang aktif dan konsisten dalam menggelar kegiatan edukasi pasar modal untuk menciptakan investor yang berkualitas.

Salah satu bukti komitmen pengembangan investor pasar modal Tanah Air adalah konsistensi Perseroan dalam melakukan edukasi pasar modal, termasuk dalam rangka Bulan Inklusi Keuangan (BIK) dan Gerakan Nasional Cerdas Keuangan (GENCARKAN) MNC Sekuritas bersama KB Valbury Asset Management kembali berkolaborasi dalam menggelar edukasi reksa dana dalam rangkaian acara Having Fund 2024.

Kali ini edukasi dilaksanakan di Telkom University, Bandung pada Kamis (13/10/2024). Pemaparan materi disampaikan oleh General Manager KB Valbury Asset Management Dede Surjadi dan Senior Marketing Mutual Fund MNC Sekuritas Wesly Andri.

General Manager KB Valbury Asset Management Dede Surjadi mengatakan bahwa saat ini para mahasiswa ataupun karyawan yang baru mulai bekerja, harus mengenal dan paham mengenai investasi.

Hal ini diperlukan agar daya beli yang dimiliki tidak tergerus oleh inflasi dengan adanya imbal hasil yang optimal dengan risiko yang terukur.

“Untuk jangka panjang, pemahaman investasi sangat diperlukan untuk mempersiapkan kebebasan finansial bagi setiap individu di masa depan,” ujar Dede.

Wakil Dekan I Bidang Akademik Fakultas Ekonomi dan Bisnis Telkom University Deannes Isynuwardhana, PhD dalam keterangannya menyampaikan bahwa mahasiswa dan mahasiswi perlu untuk diberikan literasi dan informasi mengenai pasar modal.

“Harapannya kami ingin kegiatan seperti ini terus berlanjut sehingga mahasiswa-mahasiswi dapat memahami seperti apa pentingnya pasar modal,” tutur dia.

Nikmati layanan investasi saham dan reksa dana dari #MNCSekuritas dengan segera unduh aplikasi MotionTrade dan jelajahi seamless experience.

Aplikasi MotionTrade dapat diunduh di Google PlayStore dan Apple AppStore dengan link unduh onelink.to/motiontrade. MNC Sekuritas, Invest with The Best!

Editor: Puti Aini Yasmin

---

Artikel ini telah diterbitkan di halaman inews.id pada Sabtu, 02 November 2024 - 11:44:00 WIB oleh Tim iNews.id dengan judul "MNC Sekuritas dan KB Valbury AM Gandeng Mahasiswa Universitas Telkom Belajar Investasi Reksa Dana". Untuk selengkapnya kunjungi:

https://www.inews.id/finance/bisnis/mnc-sekuritas-dan-kb-valbury-am-gandeng-mahasiswa-universitas-te...